Quick Start Guide

Don't have time to read all the details? Here’s how to start saving money on your foreign currency transactions right away:

- Sign Up for Wise: Use our referral link for potential perks, or sign up independently.

- Set Up Your Account: Verify your identity and link your business bank account.

- Top-Up Your Wise Account: Transfer money from your business bank account to Wise.

- Get Debit Card Details: Use the virtual debit card provided by Wise to make payments immediately.

- Update Your Payment Method: For Party Pro Manager users, click here to update your subscription/billing settings to use your Wise debit card.

Now, you’re ready to save on conversion fees with Wise!

Detailed Guide

Ever Felt Stung By Hidden Bank Charges?

Have you ever felt 'stung' by banks, charging excessive fees for your foreign transactions?

Whether through artificially low conversion rates or additional 'hidden' fees, traditional banks don't hesitate to charge a little extra for the privilege of making online payments in a foreign currency.

As a software provider to businesses in over 8 countries, we share your frustration and wanted to help our users save on foreign currency transactions. Determined to help, we brainstormed as a team and identified a solution that benefits everyone: Pay your foreign currency payments through Wise!

(For clarity, please note we have no affiliation with Wise, beyond our referral link, and being a long-term happy client of theirs ourselves)

Why Wise is the Solution

Wise is a great way to avoid the inflated conversion fees charged by banks. It's simple, transparent, and reliable.

Not only that, at the time of writing, it's free to set up, with no ongoing contract or monthly fees.

In this article, we'll cover:

- How to get started with Wise

- How to use Wise to save on conversion fees

- Wise Business vs. Personal Accounts

- Example of Wise Conversion Rates

- Other Benefits of Wise

- An Important Disclaimer

Getting Started with Wise

- Sign Up For Free: We have a referral link you may like to use, with potential perks for both parties (but we won't be offended if you sign up independently!)

- Set Up Your Account: After signing up, you'll need to set up your account. This involves verifying your identity and linking your business bank account.

- Top-Up Your Wise Account: Add funds to your Wise account. You can do this by transferring money from your business bank account to Wise. This will be the money you use to make payments.

- Get Debit Card Details: Wise provides you with virtual debit card details, so you don’t need to wait for a physical card. You can start using it right away.

How to Use Wise to Save on Conversion Fees

Once signed up with Wise and have 'topped up' your balance, you can pay through Wise, like you would any debit card.

For Party Pro Manager users, click here to access your Subscription/Billing settings.

(Then click 'Manage my subscription' to load up your Billing Portal and update payment info)

How Much Can I Save?

To illustrate the kind of savings you can expect from Wise, see this example:

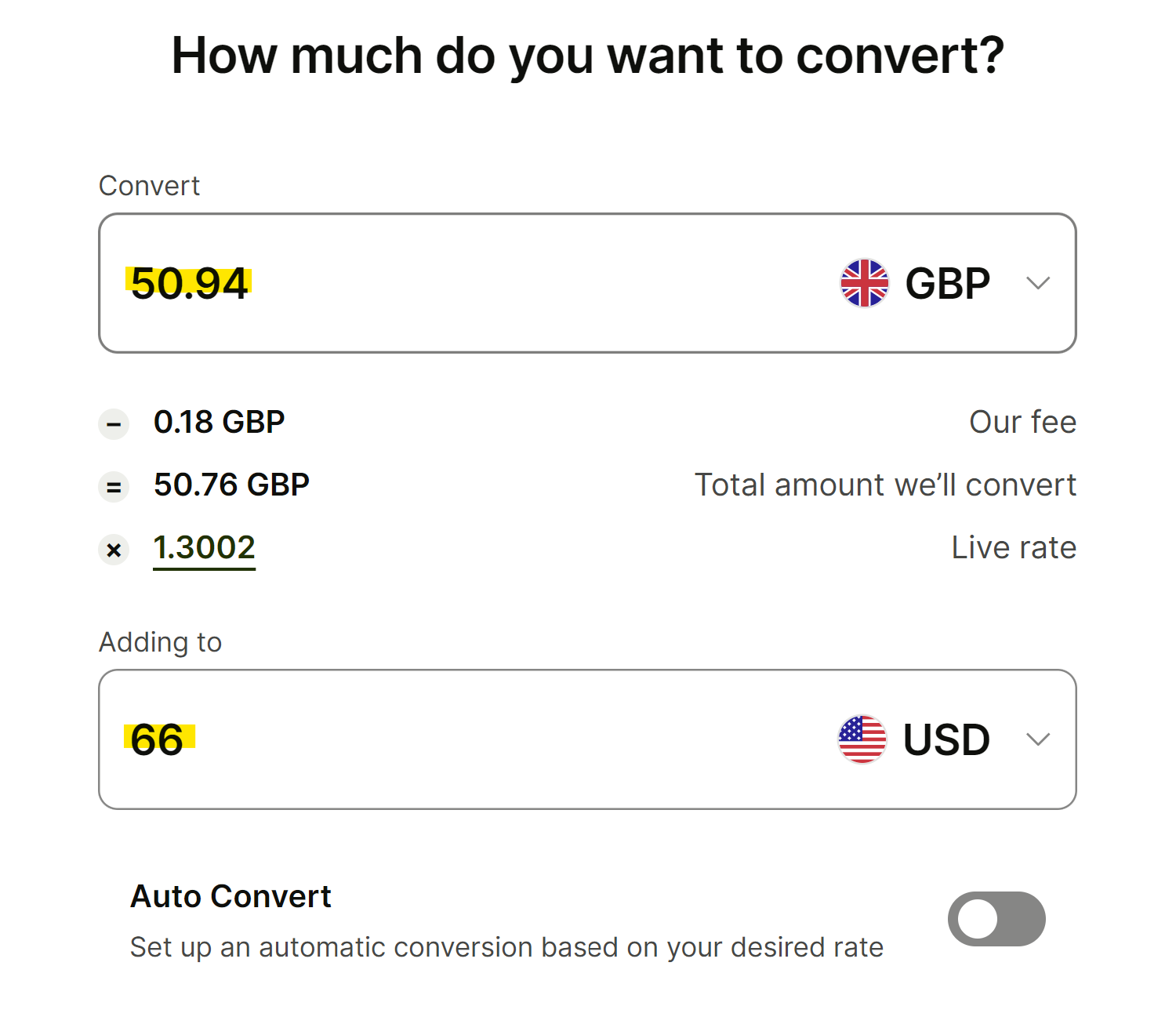

At the time of writing (July 16, 2024), a card payment for a $66 USD, would deduct just £50.94 GBP off your Wise balance - An overall conversion rate of 1 GBP = 1.3 USD, with no added fees on top!

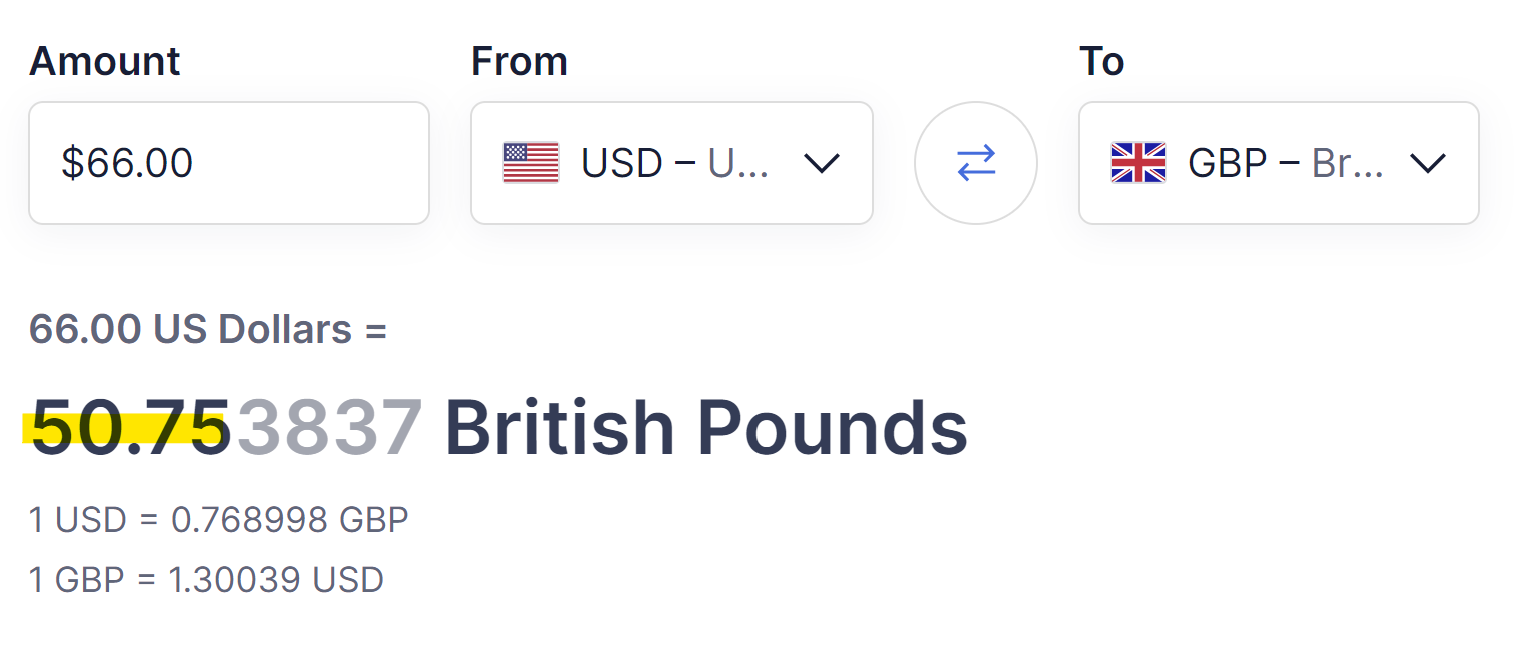

For comparison, here is a screenshot from the same date/time, taken on XE.com:

Indicating that just 19p is being lost in the overall conversion, in contrast with UK banks, sometimes charging as much as £2 - £3 on top of the amount that we actually receive.

Wise Business vs Personal Accounts

When choosing between Wise business and personal accounts, it's important to know the differences:

- Wise Personal Accounts: As of our last review, Wise personal accounts are free to set up. They come with optional paid extras, such as receiving a physical debit card. However, for many users, a virtual card will suffice for making online payments.

- Wise Business Accounts: These accounts are designed for companies and offer additional features tailored to business needs, such as multi-user access and integrations with accounting software. There may be fees associated with certain business features.

For many small business owners, starting with a Wise personal account may be sufficient, especially if you're primarily using it to make payments and avoid conversion fees. If you need more advanced features, consider upgrading to a business account.

Other Benefits of Wise

Wise offers many other benefits beyond avoiding conversion fees, such as:

- Multi-Currency Accounts: Hold and convert money in multiple currencies.

- Low Transfer Fees: Send money abroad at low cost.

- Fast Transfers: Quick and reliable money transfers.

However, this article is focused on how Wise helps you avoid conversion fees.

Important Disclaimer

Always do your due diligence when choosing a financial service. Consider all options and read Wise’s Terms and Conditions. This article is intended to provide helpful information, but please make the best decision for your business needs.